Labor System and Labor Law in Germany

Summary

Content

Organisational requirement

The prerequisite for refugees to be able to go to work is the Registration. Responsible is the Foreigners' Registration Office at the respective place of residence. There Ukrainians receive a residence permit.

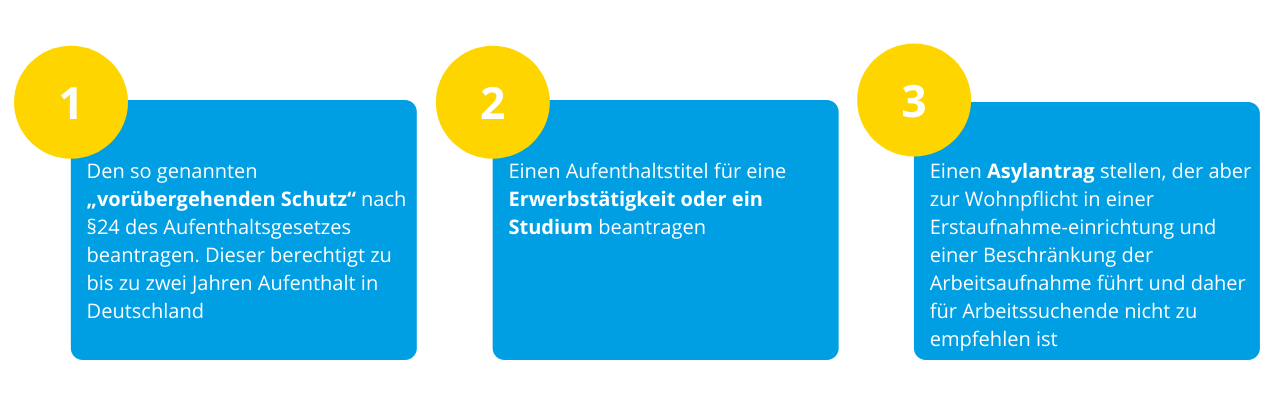

Refugees have three options for a long-term residence permit:

In any case, the acquired residence title must be accompanied by the note "Gainful employment permitted" in order for Ukrainian refugees to be allowed to work here.

Structure of working hours and contracts

In the German labor system, there are three different work formats for employees: full-time work, part-time work and mini-jobs.

In Germany, full-time employees generally work 40 hours per week.

Part-time work refers to all contracts that involve less than 40 hours of work per week and still provide more than 520 euros as a monthly salary. With a part-time job, one usually earns less money than for a full-time job. For example, with a working time of 32 hours per week, one receives about 80% of the full-time salary.

The mini-job or 520-euro job is the lowest official form of employment in Germany: a maximum of 520 euros may be earned per month. As soon as the earnings exceed this limit, it is no longer a mini-job. Apart from that, 12 euros per hour is considered the minimum wage. However, full-time jobs and mini-jobs differ not only in terms of salary, but also in terms of taxes. Employees usually only pay contributions to pension insurance. Employers pay less tax because they do not pay contributions to the health insurance fund, for example. Of course, employees also receive their wages when they are sick, and have vacation and protection against dismissal. Last but not least, full-time workers are additionally allowed to have a mini-job.

Labour law

The following framework conditions apply, especially to protect employees:

- Work entitles you to health insurance and pension insurance (the costs are deducted directly from your gross salary, employees do not have to pay anything).

- Since October 1, 2022, the minimum wage has been 12 euros per hour (in July 2022 it was still 10.45 euros)

- Overtime is paid or compensated in time off

- One receives night, Sunday and holiday bonuses

- Vacation should be requested as far in advance as possible

- In case of illness, a doctor's sick note must be submitted (usually after the second or third day of absence, this condition is written in the employment contract)

- As a rough rule of thumb for taxes, unmarried people without children receive about half their gross salary net after taxes, while married people with children receive about two-thirds of their gross salary net

Here is an overview in Ukrainian.